Recession is the new buzzword. Everyone’s predicting it. Algorithms predicting the possibility of it are churning various possibilities. Some say 40 percent. Some think 60 percent. Goldman Sach says that there is now a 48 percent chance of recession and Elon Musk has joined the chorus of “inevitability” of it as well. New York Fed sees only a 10 percent chance of soft landing for U.S. economy and an 80 percent chance of a hard one (essentially, a recession).

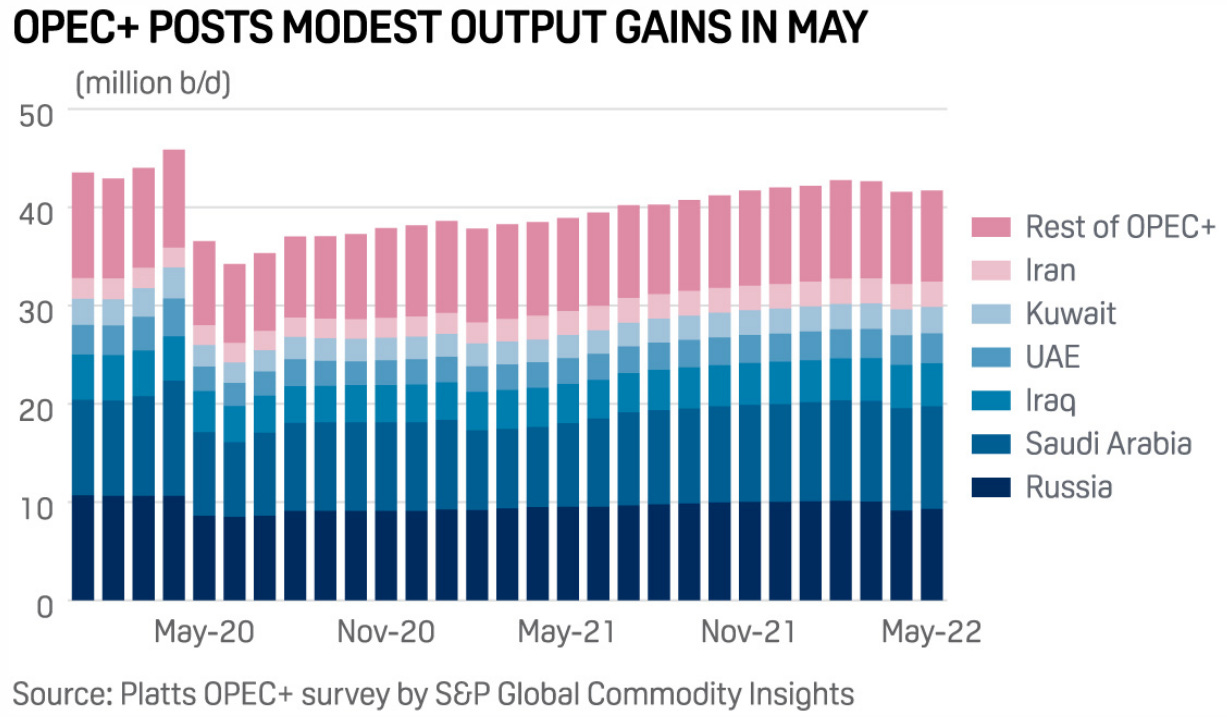

The global sentiment has certainly swung between two extremes recently. At one point the investors and traders feared a sharp rise in demand along with a less than required supply plus the falling spare capacity of the major oil producers (now said to be at or less than 1 mbpd as OPEC+ has decided to increase its output) will usher in an era of permanently higher oil prices. OPEC+ has continued to underproduce as compliance touched 220 percent few weeks ago. Recently, it has jumped to 256 percent as the cartel produced 2.7 mbpd below its target due to sanctions.

On the other hand, increasing interest rates by the global central banks, with more than 80 increases in the first 6 months of 2022, got the markets worrying of a recessionary period as higher interest rates, inter alia, effects the demand of commodities for countries that imports e.g. crude oil. This is the reason that why crude oil has shed some dollars recently.

The question is will the recessionary worries overwhelm the concerns for undersupply? I don’t know and I doubt anyone does.

In other news, China has increased its imports of Russian oil by an impressive 28 percent as Russia overtakes Saudi Arabia as China’s largest oil supplier. India’s importas has jumped 786,000 bpd. Overall sales to India from Russia has increased to 8410,000 bpd this year which is 8 times more than the last one. West has heavily sanctioned Russia and its production has fallen as well. However, due to elevated energy prices, the country was able to earn $1.7 bn more in May’22 as compared to April’22. Russia’s oil sales to Europe dropped 554,000 from March to May but almost an equal amount was replaced by the Asian market which has literally rescued the country by buying 503,000 bpd out of which 165,000 bpd goes to China. According to an estimate by JP Morgan China can still buy a further million barrel of oil from Russia.

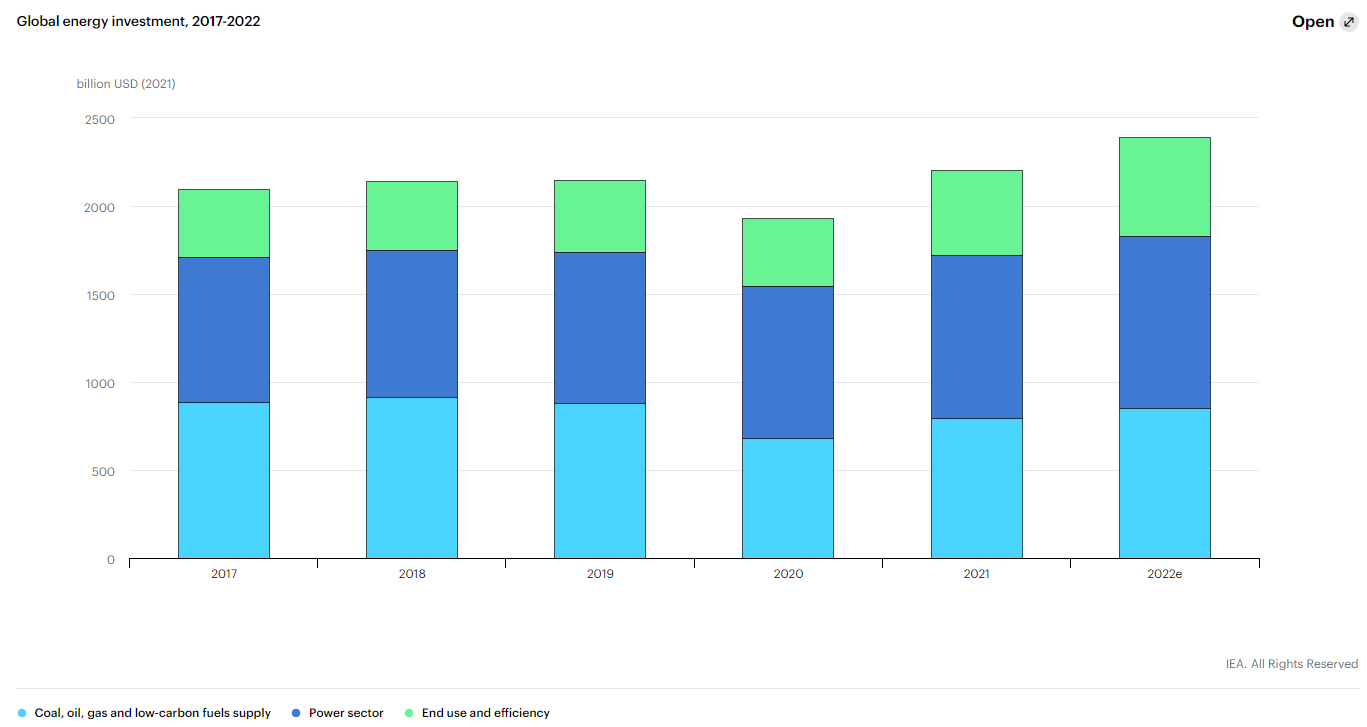

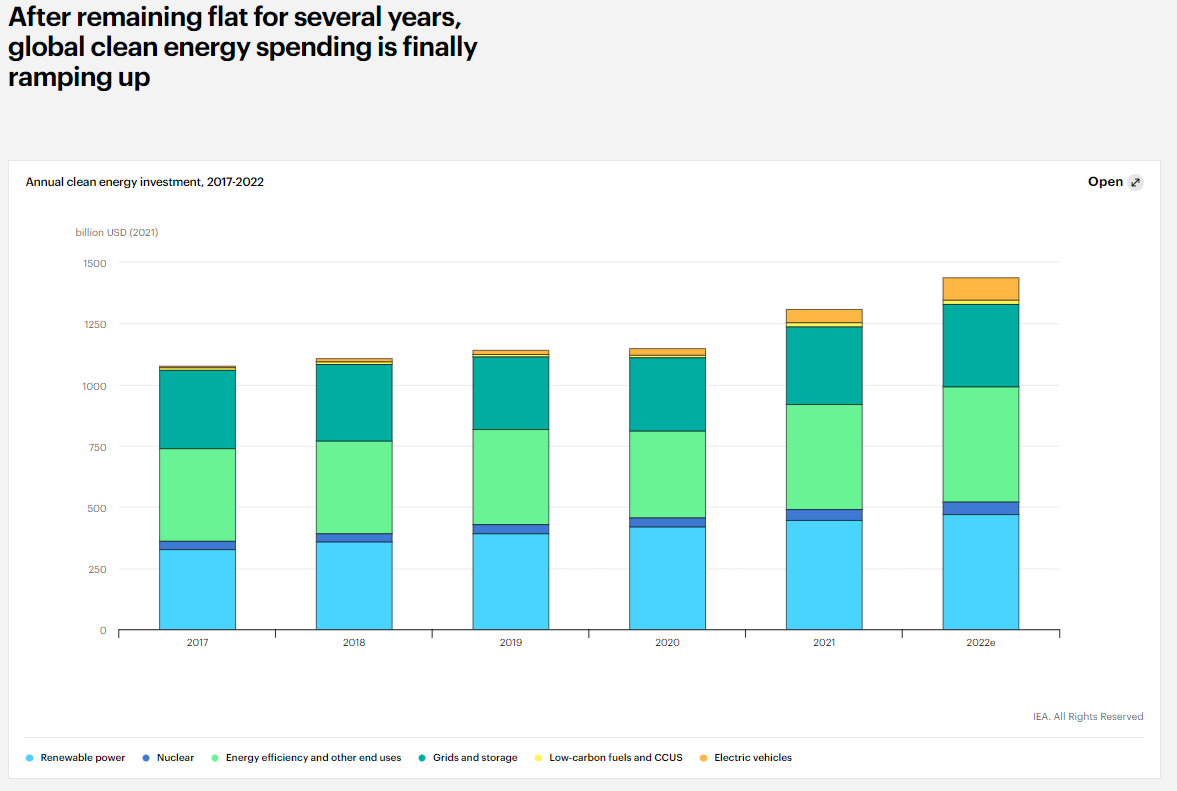

IEA’s Energy Investment Report came out today as well. I will be doing a seperate post on it by the end of the week. But just wanted to share some key takeways.

There is a good news regarding energy investment that is set to rise 8 percent in this year however, most of this increase is due to higher costs. If we go into some detail, we find that investments in renewables and power sector have certainly boosted but oil, coal, and gas are the only few in which the levels remain below where they were in 2019. It is instructive to note that this is happening despite an “unprecedented” surge in profits for the oil and gas sector that has seen profits touching $4 trillion!

Speaking of energy, coal plants are being restarted across Europe and even the IEA has warned Europe that it might face a complete halt of Russian gas supplies this winter, in an article for FT. It is ironic, as last year it was the same IEA that had called for zero investment in oil and gas if the world wants to cater to its climate ambitions. They were absolutely right. But the problem is that they are also right right now. That is the dilemma and I intend to cover it throughout my upcoming writings (in fact my whole life, as it pertains to the issue of economic development and therefore standards of living for the developing world).

This was meant to be a short post so I will keep it that way. I’ll try to write something by the weekend. There will be more calls for a recession by then!